Ani Nurwanti never imagined that she could own a watch and a cellphone. For him, being able to meet the daily needs of himself and his family is more than enough.

Moreover, in her daily life, Ani, who is just a housewife, works as a canteen trader at MAN Subang. At the school he sells stationery equipment and snacks for school students.

In developing his business before the Covid-19 pandemic, Ani sought business capital for a school canteen and purchased goods through the Akulaku Finance Indonesia digital credit platform. However, it was very unfortunate, when schools were closed because positive cases of Covid-19 continued to soar in Indonesia, his business activities then stopped.

Finally, Ani had to use the money she had borrowed to sell money in the school canteen to meet her daily needs. This is of course caused by conditions that make it impossible to sell.

“During the Covid-19 pandemic, I feel that I still have convenience. This is because the installments for my goods to Akulaku were restructured. My obligations are paid off for a month’s installments. “So just pay again next month,” said Ani, a customer from Subang.

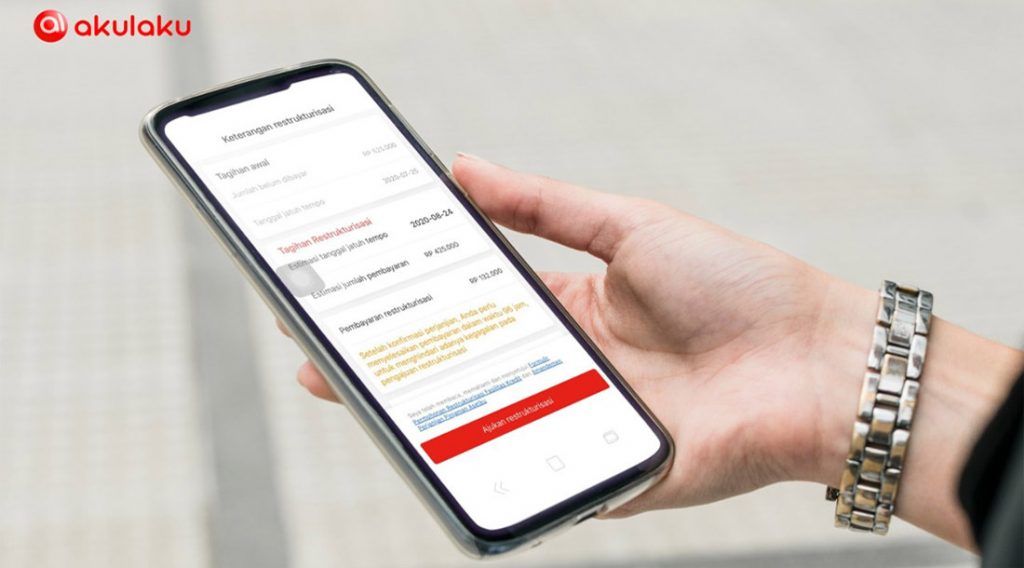

He admitted that in order to obtain credit restructuring, Ani said he had to first take care of the requirements according to those stated in the company’s application. However, said Ani, the application was not difficult.

In terms of settling obligations, according to him, the company does not prioritize arrogant methods. According to him, this company better understands the needs and conditions of traders during the COVID-19 pandemic.

“They didn’t really bother asking for the installments, they didn’t call many times. Especially now that the situation is difficult, monthly installments can be paid in stages. Installments are per month, but the installment payments can also be paid in installments, so if you have money, put it in to pay the installments. “It’s really helpful for traders whose income is every day,” he said.

Bangun Elbayan, an online motorcycle taxi partner who also uses the Akulaku Finance digital credit platform, conveyed the same thing.

According to Elbayan, he knew Akulaku from Facebook posts. Then, his intention arose to try to make a loan through the digital credit platform. Elbayan admitted that he was brave enough to try because the conditions were not complicated.

“The requirements are quite easy. If I borrow, I adjust it according to my ability to pay. So there’s no problem,” he said.

Akulaku Finance is a digital credit platform that provides shopping facilities using installments. During the Covid-19 pandemic, this company is known to have complied with the directions of the Financial Services Authority (OJK) by carrying out credit restructuring to ease the burden of obligations on its affected customers.

This restructuring is a policy issued by the OJK, as the supervisory institution for the Indonesian financial industry. One of the aims of this policy is to ease the installment burden on financial institution customers in Indonesia.

As of July 2020, Akulaku Finance is known to have restructured 13,876 debtors with total loans reaching IDR 47.3 billion. With that figure, overall customers who applied for relief reached 36,478 customers.