JAKARTA, 6 October 2020 – During the Covid-19 pandemic, the Indonesian government continues to take various steps to deal with it, both in the policy aspects of health and security, including the economic sector. This last aspect certainly cannot escape the attention of the government, and among the various industries that play an important role in Indonesia, the financial services sector is one sector that is expected to be able to drive the nation’s economy at this time and play an important role in the National Economic Recovery (PEN) program. .

The Financial Services Authority (OJK) as the regulator of the financial services industry has established several programs to improve public financial access and run the PEN program, including the KUR cluster program, Lakupandai, Jaring, Micro Waqf Bank and Credit Financing Against Loan sharks (KPMR) which is coordinated in The Regional Financial Access Acceleration Team currently has 195 teams in various regions in the country.

Member of the OJK Board of Commissioners for Education and Consumer Protection, Tirta Segara, explained that financial inclusion has an important and strategic role so it is hoped that it can be an effective solution to accelerate national economic recovery due to the Covid-19 pandemic.

“We believe, with a better level of public knowledge and understanding regarding financial products and services, accompanied by adequate financial management capabilities, we will be able to encourage people to use financial products and services that suit their needs and abilities in economic activities,” said Tirta in opening of Financial Inclusion Month 2020.

In line with this, Deputy for Macroeconomic and Financial Coordination, Coordinating Ministry for the Economy, Iskandar Simorangkir also said that financial inclusion has an important role for national economic recovery, especially by accelerating the acceleration of providing working capital to Micro, Small and Medium Enterprises (MSMEs) in order to increase activities. business.

“Accelerate the provision of credit to MSMEs so that their businesses can increase again to normal conditions. “Then the savings movement becomes the next priority, because of the need for spending from the public to drive the real sector,” said Iskandar in his opening remarks at the 2020 Financial Inclusion Month, Monday (5/10/2020).

According to him, with the Financial Inclusion Month (BIK), it is hoped that the financial inclusion index will increase in accordance with President Joko Widodo’s direction, January 28 2020 at the Limited Meeting on the National Financial Inclusion Strategy from 76 percent to above 90 percent within the next 3 years.

“Indonesia’s financial inclusion index is currently still 76.2 percent. “Even though it has risen rapidly, this index is still below China and India which reached 80 percent in 2019,” said Iskandar. Iskandar also revealed that increasing financial literacy can also accelerate the achievement of the financial inclusion index which will ultimately lead to the welfare of the MSME community.

Regarding Financial Inclusion Month 2020, Deputy Commissioner for Education and Consumer Protection of the Financial Services Authority, Sarjito said that the 2020 BIK series was implemented to support the recovery of the national economy in order to increase public understanding of financial products and services as well as encourage acceleration in increasing the number of accounts and the number of products or services financial services.

“With various financial literacy and consumer protection activities, we involve financial services institutions, banking as well as e-commerce and fintech to distribute credit for financing MSMEs, opening accounts and various sales of financial services as well as various special promotions to attract public interest in celebrating Inclusion Month “Financial 2020,” said Sarjito at the opening of BIK 2020 via live broadcast.

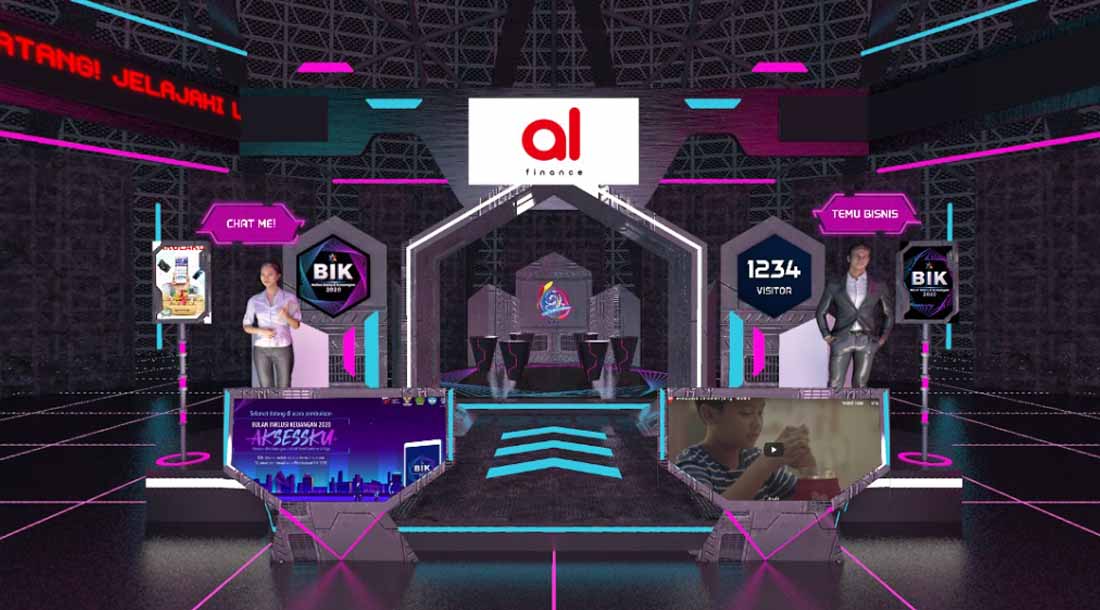

Taking into account the current conditions of restrictions on social activities, the BIK 2020 series of events will be held virtually, one of which is by running a virtual expo through an online portal where there are 300 booths that will display product/program promotions via videos, e-posters, e-flyers from ministries, financial services institutions, banking and ecommerce or fintech.

Efrinal Sinaga, President Director of Akulaku Finance Indonesia said, “As a form of collaborative effort to increase Indonesia’s financial inclusion, Akulaku Finance Indonesia as a digital-based financing company also participated in a virtual exhibition which was part of the BIK 2020 program which was held from 5 October – 3 November 2020. People who want to know more about inclusive financial services in the Akulaku ecosystem can directly visit the site www.bik2020.id, enter the BIK Expo feature, and look for a virtual booth from Akulaku Finance in financing cluster 2 and guarantees.”

“Akulaku Finance tries to move in line with the government’s efforts to increase the national financial inclusion index. These include preparing educational webinar programs regarding financial inclusion, and also offering various financing promos carried out with contactless and cashless concepts. “We invite the public to try Akulaku Finance’s digital financing services during our participation in BIK 2020,” said Efrinal.

“We hope that the campaign and collaboration efforts of 300 financial service institutions in BIK 2020 can help stimulate the national economy and further increase the level of financial inclusion and access to funding for the Indonesian people. “Akulaku Finance will consistently and continuously remain focused on increasing community financial inclusion until after the end of BIK 2020 on November 3 2020 through educational activities and collaboration with various financial industry sector players,” concluded Efrinal.